Our Process |

Passive or Active Management |

Offshore Investments |

|

We use machine learning algorithms to trawl the market and create customised risk targeted, goal orientated portfolios.

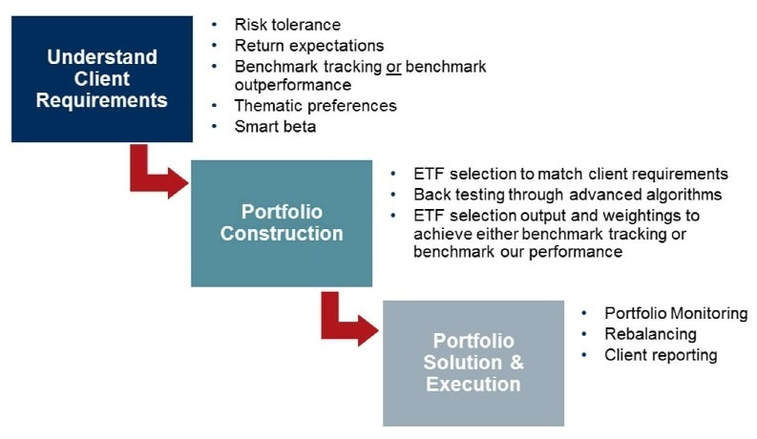

Our process is to: 1. Investigate and select the ideal asset classes for the current economic environment. 2. Select the lowest cost, most efficient way to get exposure to these assets 3. Determine your risk tolerance so we can create a portfolio best suited for your needs 4. Find the optimum combination of those assets to achieve the highest return for different risk levels 5. Monitor and rebalance your portfolio as needed taking into account the cost of trading. |

We have worked closely with clients and crafted bespoke solutions based on an understanding of their investment needs.

This is done either through the creation of a passive or active management role in the portfolio construction. |

As more clients have decided to externalise their assets and look for offshore opportunities, the we have actively sourced innovative exchange-traded funds (ETF’s) to mitigate risk around stock selection, and have focused more on a thematic and Smart Beta offering, ensuring clients exceed the requisite benchmarks.

Through extensive testing and examination of offshore risk (company risk, market risk, geographic risk, currency risk and economic policy risk) we have evolved our offshore offering to be largely exchange traded fund (ETF) based. |

How We Invest

We design tailor made portfolios to fit your clients needs.

Our algorithms take into account the opportunities in the market for both risk and return.

Resulting in a diversified portfolio which spreads your risk while allowing for maximum gains.

Exchange Traded Funds (ETF's)The portfolio will comprise exchange traded funds.

|

Risk-returnsThe portfolio recommendation aims to achieve superior returns for the same level of risk (or equal returns at a lower level of risk). A well-structured ETF portfolio is highly effective in lowering overall costs as well as lowering risk through diversification.

This combination will enhance returns over the long term as the drag on returns from frequent trading (timing risk, trading costs and risk inherent in stock picking) is reduced. |

"Asset Management gains prosperity when our clients prosper.

This ensures that all delivery efforts result in one outcome- success for our clients.”

- Arcus Capital

|

Our technology generates millions of portfolios and we analyse each portfolio’s particular mix of asset classes in order to maximize the expected return for a specific level of risk. We also analyse whether adding an additional asset to the mix improves the outcome in a significant way.

We use at least 12 years of past history (includes at least 3 cycles as well as a major downturn) to determine how each asset behaves in relation to other assets. It’s important to realise that future returns, especially over the short term, are very dynamic, i.e. it’s unlikely that the future returns will occur exactly as they did in the past. However, the behaviour of asset classes to each other remains broadly consistent over time. We use both historic returns as well as forward looking expected returns which we base off long term risk premia. Our results are thus rigorous and replicable going forward. After doing all this, we reduce our couple million portfolios down to a final handful of “best” portfolio which we offer to you. |

The composition of your portfolio naturally changes over time as the market moves and certain assets do better than others. Your portfolio could then increase in risk or become sub-optimally mixed.

Your portfolio must thus be periodically rebalanced to manage this risk – the primary goal of any rebalancing strategy is to minimise risk relative to a target asset allocation. We use sophisticated algorithms to determine the optimal rebalancing of your portfolio taking into account risk, tax and trading expenses. |

DIGITAL WITH A HUMAN TOUCH

READY TO OPTIMISE YOUR BUSINESS

READY TO OPTIMISE YOUR BUSINESS